Consider Our Direct Care TO COVER VISITS WHEN high deductible INSURANCE DOESN'T

The House Ways and Means Committee just passed bipartisan legislation containing a provision that would allow Direct Primary Care (DPC) arrangements to be compatible with Health Savings Accounts (HSAs). Patients, employees, unions etc... will be able to pay for our direct care telehealth out of their HSA's thereby avoiding out-of-pocket fees as with HDHP'S.This is a common-sense solution that will benefit millions of Americans. We look forward to seeing this legislation pass the full House soon.

BREAKING: Bill To Expand Direct Primary Care Passes House. March 5, 2024

This legislation removes barriers for Medicare, Medicaid, Tricare and allows HSA's to fund direct primary care for employers and employees. Stay tuned for more good news...

Telehealth for Employee Caregiver Support is Another Great Benefit

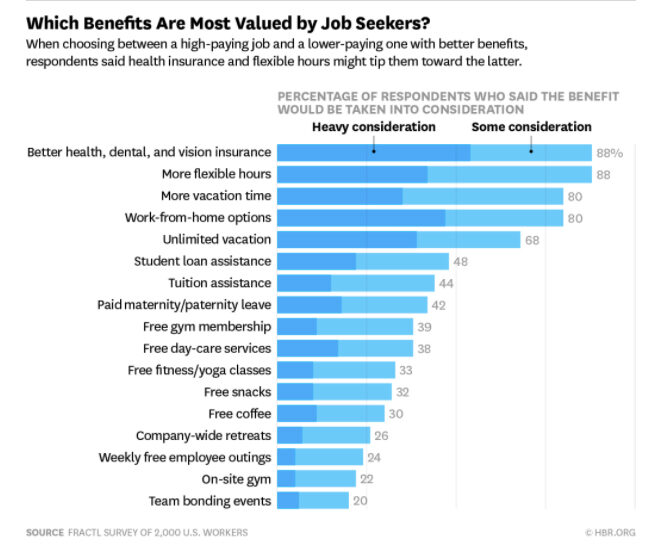

Healthcare Benefits at the Top of the List for Employees

EMPLOYER TELEHEALTH BENEFITS

About 75% of all doctor, urgent care, and ER visits “are either unnecessary or could be handled safely and effectively over the phone or video,” according to statistics from the American Medical Association and Wellness Council of America.

Telethink telehealth provides 24/7/365 concierge service for your employees while avoiding unnecessary health insurance claims, deductibles and copays. Businesses can save up to 40% to 50%.

No co-pay, no deductible, no consultation fee, family plan (up to 7 dependents), unlimited access. Any language available upon request, senior parents and college students eligible.

Our full, comprehensive healthcare benefits bundle starts at just $10/month/employee household (group rates). Onboarding services provided. A service agreement is all we need to get started.

E-mail telethink@protonmail.com for quote or, leave a message to speak with a representative. We're always open.

TELEMEDICINE: Board Certified Primary Care and Urgent Care Physicians, with Licenses in All Fifty States and Puerto Rico for Healthcare Coverage Nights, Weekends, Holidays, Vacation, Sick Leave, Maternity Leave, Business Travel, Anytime, Anywhere.

MENTAL HEALTH: Anytime/Anywhere, for Concerns Such as: Abuse, Addiction, Anger Management, Anxiety, Caregiver Stress, Codependency, Conduct Disorder, Depression, Divorce, Eating Disorder, Grief/Loss, Insomnia, LGBT Issues, Mood Swings, Men's Issues, OCD, Panic Attacks, Parenting, PTSD, Relationships, Sexual Abuse, Sexuality, Smoking Cessation, Social Anxiety, Stress Management, Substance Abuse, Trauma, and Women's Issues.

CARE NAVIGATION: Explanation of Benefits, In-Network Providers, Out of Pocket Costs. Guidance and Navigation to Make Health Care Easy to Access, Understand and Use.

SPECIALTY REFERRAL: Get a Quick and Easy Specialty Referral For Any Condition Your Primary Care Physician Doesn't Treat

p